What is Form 26AS ?

Form 26AS is also known as Annual Consolidated Statement (Tax Credit Statement), is an important document that contains all tax-related information of the taxpayers (Assesses) like:-

Form 26AS is also known as Annual Consolidated Statement (Tax Credit Statement), is an important document that contains all tax-related information of the taxpayers (Assesses) like:-- Tax Deducted at Source (TDS) on Salaries, Interest, Consultancy Income, Contract Income, Commission Income Etc

- TDS for Form 15G / Form 15H

- TDS on Sale of Immovable Property u/s 194Ia (For both Seller and Buyer)

- Tax Collected at Source (TCS)

- Tax Paid (Other than TDS or TCS) like Advance Tax, Self Assessment Tax, Tax on Regular Assessment

- Details of Paid Refund

- Details of Annual Information Return (AIR) Transaction

Now, let us see the step by step guide to view and download the Form 26AS from the New Income Tax Website:

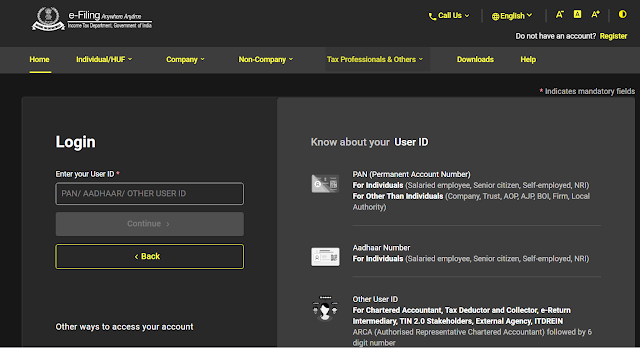

(A). Visit to the New Income Tax Portal - https://www.incometax.gov.in at the top right corner of the website you will able to login

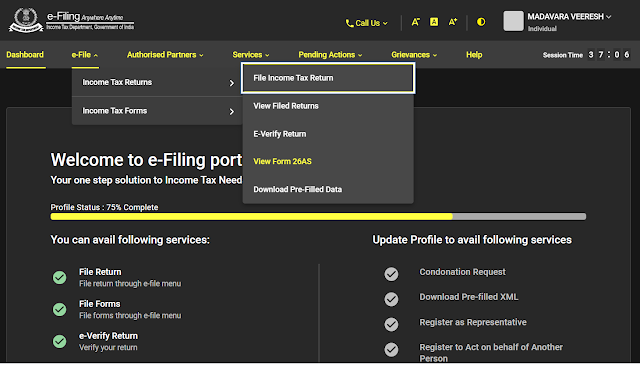

(B). Now go to e-file > Income Tax Returns > Click on View Form 26AS

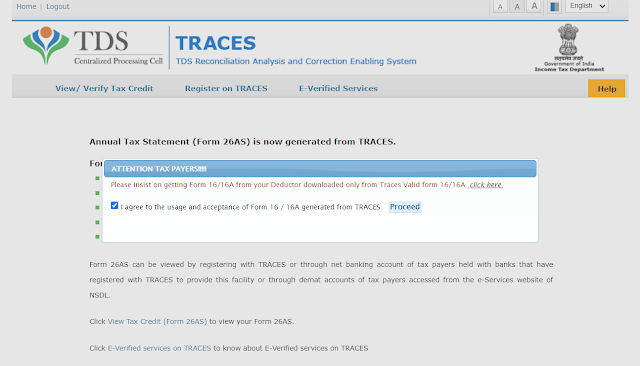

(C). You will be redirected to the TDS-CPC website to view and download Form 26AS after confirming the Disclaimer. In TDS-CPC website, agree to the acceptance of usage and then Proceed with

(D). Click 'View 26AS' under 'View/Verify Tax Credit'

(E). Select relevant Assessment Year and View as 'HTML' and click on View/Download or Export as PDF ( To see FY 2019-20 select AY 2020-21)

Form 26AS is one of most important document that one has to check and reconcile with their Income while filing their Income Tax Returns (ITR) of any Assessment Year to avoid any future tax notices from the Income Tax Department.

0 Comments